Bank Accounts

Youth Accounts: It is a savings account reserved for youths ages 18 and under.

The features of this type of account are that there are few fees, unlimited number

of transactions, free record keeping, usually no minimum balance and there is a

small amount of interest that you can earn. The cons of this are that it is

limited to those aged 18 or under and there are debit limits meaning there is a limit

on how much you can spend or withdraw.

Youth Accounts: It is a savings account reserved for youths ages 18 and under.

The features of this type of account are that there are few fees, unlimited number

of transactions, free record keeping, usually no minimum balance and there is a

small amount of interest that you can earn. The cons of this are that it is

limited to those aged 18 or under and there are debit limits meaning there is a limit

on how much you can spend or withdraw.

Chequing Accounts: This account was designed to be used to make payments. They have high or no limits to their number of withdrawals or deposits. This account always has a record of your spending. This account is accessible through online banking and ATMs. Some downsides of this account are that there are maintenance fees and ATM fees, some accounts require a minimum balance and they usually pay little to no interest.

Savings Accounts: These are accounts that pay you interest by

maintaining a balance in the account. They have relatively high interest rates

compared to the other accounts. You can open this account with little money that

you can save to grow your savings. These accounts have withdrawal limits and occasionally

a minimum balance requirement.

Savings Accounts: These are accounts that pay you interest by

maintaining a balance in the account. They have relatively high interest rates

compared to the other accounts. You can open this account with little money that

you can save to grow your savings. These accounts have withdrawal limits and occasionally

a minimum balance requirement.

Let's Apply our Knowledge!

- Bob is 17 years old and wants to open a bank account to start saving. Which type of bank account should he open?

- What is a benefit of a chequing account?

- Which type of account should you maintain a balance in?

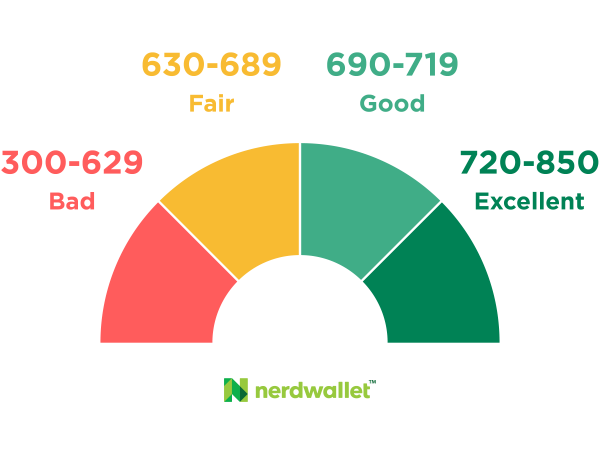

A credit score is a numerical representation between 300 - 900 of how well an individual is able to manage their credit. The higher the score, the better it is for the individual as it shows that they are good at managing their credit. This lets lenders know how risky it is for them to lend money to the individual. Lenders will want to know if the person they are giving money to will actually be able to pay them back on time. With a better credit score, you have a higher chance of having loans being approved by lenders.

A credit score is a numerical representation between 300 - 900 of how well an individual is able to manage their credit. The higher the score, the better it is for the individual as it shows that they are good at managing their credit. This lets lenders know how risky it is for them to lend money to the individual. Lenders will want to know if the person they are giving money to will actually be able to pay them back on time. With a better credit score, you have a higher chance of having loans being approved by lenders.

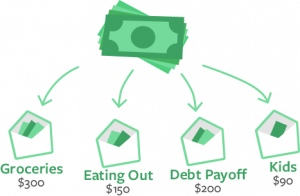

A budget is a plan that you create to track money you are making (income) and the money you are spending (expenses). This lets you put money aside for saving and help plan your spending. Whenever you create a budget plan you should decide on what your goal is for saving or spending. This goal would include how much money you will need in how long. You then want to list out your different income sources and expenses and how much money is involved for each source and expense. Examples of sources would be wages, self employment income and tax benefits while some examples of expenses would be bills, groceries and any current savings. You can take a look at this list and sometimes cut out any expenses you feel are unnecessary.

A budget is a plan that you create to track money you are making (income) and the money you are spending (expenses). This lets you put money aside for saving and help plan your spending. Whenever you create a budget plan you should decide on what your goal is for saving or spending. This goal would include how much money you will need in how long. You then want to list out your different income sources and expenses and how much money is involved for each source and expense. Examples of sources would be wages, self employment income and tax benefits while some examples of expenses would be bills, groceries and any current savings. You can take a look at this list and sometimes cut out any expenses you feel are unnecessary.

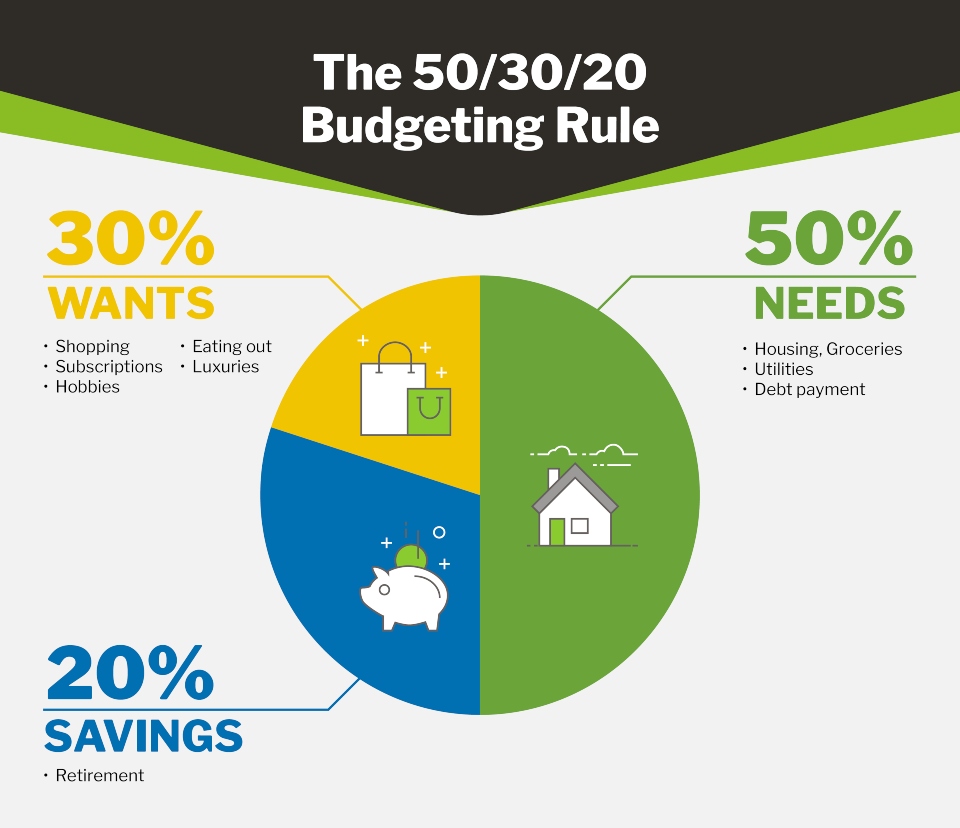

A way to determine unnecessary expenses is by categorizing them as needs or wants. You should make sure that your expenses do not have a total which is higher than your total income. With this extra money you can either save it for things like emergencies or invest it. Putting this plan in action can be difficult so it's best to start slow and then slowly increase the amount of money you save as you start to understand your spending habits. After this there can still be many changes to your plan as other things pop up such as seasonal expenses (yearly events like trips or birthdays) or a major financial event (like the loss of your job). It is always important to re-evaluate your plan whenever events like these occur.

A way to determine unnecessary expenses is by categorizing them as needs or wants. You should make sure that your expenses do not have a total which is higher than your total income. With this extra money you can either save it for things like emergencies or invest it. Putting this plan in action can be difficult so it's best to start slow and then slowly increase the amount of money you save as you start to understand your spending habits. After this there can still be many changes to your plan as other things pop up such as seasonal expenses (yearly events like trips or birthdays) or a major financial event (like the loss of your job). It is always important to re-evaluate your plan whenever events like these occur.